That is half 2 of Jeff Goldsmith’s historical past of managed care. If you happen to missed it learn Half 1

By JEFF GOLDSMITH

The late Nineteen Nineties crash of HMOs opened the door to a serious consolidation of the medical health insurance market managed largely by nationwide and super-regional well being plans. Whereas HMOs not at all disappeared post-backlash, the “motion” begun by Ellwood and Nixon fell far wanting nationwide attain. HMOs by no means established a significant presence in essentially the most quickly rising elements of the US- the Southwest, South and Mid-Atlantic areas, in addition to the Northeast.

The exemplar, Kaiser Permanente, broken its monetary place with an ill-considered 1990’s (McKinsey-inspired) push to develop into a “nationwide model”. Right now, over 80% of Kaiser’s 13 million enrollment remains to be within the West Coast markets the place it started 80 years in the past!

HMOs Go Public and Roll Up

Two little observed developments accelerated the shift in energy from suppliers to payers. One was the motion of supplier sponsored well being plans into the general public markets. PacifiCare, essentially the most vital hospital sponsored well being plan owned by the Lutheran Hospital Society of Southern California, was taken public in 1995. A subsequent merger with FHP well being plan destabilized the newly public firm.

After PacifiCare crashed publish the 1998 Balanced Finances Act cuts, and struggled to refinance its debt, it was acquired by United Healthcare in 2005, bringing with it an enormous subtle, delegated danger contracting community. United then purchased Sierra Well being Plan based mostly in Nevada in 2007, together with its massive captive medical group, its first medical group acquisition. Following these acquisitions, United rolled up PacifiCare’s southern California based mostly at-risk doctor teams within the late 00’s, after which capped off with its buy of HealthCare Companions, the most important of all, 2017 from DaVita in forming the spine of right now’s $110 billion Optum Well being.

United’s shopping for BOTH sides of the delegated danger networks-plan and docs-in excessive penetration managed care markets will not be absolutely appreciated by most analysts even right now.

It has meant that as a lot as 40% of Optum Well being’s revenues, together with nearly $24 billion in capitated medical health insurance premiums, come from opponents of United’s medical health insurance enterprise.

Nevertheless, of larger strategic significance was Humana’s resolution in 1993 to exit the hospital enterprise by spinning its 90 hospitals off as Galen.

Humana’s unsentimental founders, David Jones and Wendell Cherry, concluded that the extraordinary doctor push again towards their rising well being plan meant that their two enterprise have been basically incompatible, they usually selected to retain possession of the upper margin and fewer advanced enterprise.

Galen hospitals started a prolonged and unhappy journey by a number of owners-Rick Scott’s ill-starred Columbia/HCA, Tenet, after which a number of others. Right now, Humana is the second largest “participant” within the Medicare Benefit market, and had a market cap north of $60 billion (till a month or so in the past).

HIPAA Units Stage for twenty-four/7 Digital Surveillance of Medical Determination Making

The opposite little remarked improvement supplied the technical basis for a payer managed care system- the Well being Insurance coverage Portability and Accountability Act of 1996 (HIPAA). Up till the mid-Nineteen Nineties, healthcare claims have been paper and fax transmitted, pricey and unreliable. Although HIPAA is principally recognized for its confidentiality protections for affected person information, its Administrative Simplification provisions set information requirements to encourage digital submittal and cost of medical claims.

HIPAA inspired the emergence of digital information interchange by devoted T-1 strains, hardwired ancestors of right now’s VPNs–excessive capability, safe bodily hyperlinks between hospitals and their main payers. HIPAA markedly accelerated the usage of digital information interchange (EDI) in healthcare, to the nice benefit of well being insurers.

HIPAA spawned a complete ecosystem of small firms who served as monetary intermediaries between well being insurers and care suppliers–aggregating, transmitting and processing medical claims and paying suppliers for his or her care. These firms proliferated through the first Web funding bubble, which started after Netscape’s historic IPO in 1995. When the Web bubble burst in 2000, these firms have been offered by their personal fairness and enterprise homeowners in an ensuing multi-year hearth sale.

PPO Progress Burns Down the Industrial Charge Construction

Whereas the HMO motion faltered, provider-centric delegated-risk capitation gave method to broad panel “most popular supplier group” (PPO) managed care which paid physicians and hospitals a reduced fee-for-service, and overlaid exterior utilization controls like prior authorization. The PPO motion markedly diluted doctor financial energy. PPOs have been mainly an industrialized model of conventional Blue Cross, solely with out doctor or hospital governance enter.

PPO well being plans threatened to exclude native suppliers that didn’t grant them vital reductions. Unbiased physicians had zero leverage on this transaction. Hospitals who discounted their charges within the panic to keep away from being excluded found that their pricing concessions yielded no progress in quantity or market share, simply decreased revenues. This late Nineteen Nineties pricing panic burned down hospital business price constructions within the West and Southwest, as far east as Chicago, Minneapolis and St. Louis, and accelerated the pattern to system consolidation.

The ObamaCare Competition of Technocratic Enthusiasm

On the identical time, Medicare moved aggressively to get suppliers into a brand new, much less politically inflammatory model of managed care for big common Medicare market (e.g. the non-Medicare Benefit portion). The 2010 Reasonably priced Care Act’s major occasion was to broaden well being protection to the working poor by a partial nationalization of the person insurance coverage market and an aggressive enlargement of Medicaid. This protection enlargement was an enormous success, bringing new protection to 30 million People.

However in a muted afterthought, recognizing persevering with well being price stress, ObamaCare additionally sought to revive, for one final time, for normal Medicare, the Ellwood/Enthoven imaginative and prescient of a remodeled, at-risk care system. Having concluded that the closed panel, capitated built-in care system mannequin couldn’t be reached in a single unimaginable transformation, because the Clintons tried and did not do, it could sow the seeds of capitation by a “managed care” lite mannequin referred to as Accountable Care Organizations.

There have been two ACO concessions to the post-HMO backlash surroundings. First, Medicare sufferers weren’t pressured into managed care plans (and even instructed they have been in them), and suppliers can be insulated from draw back monetary danger for a prolonged interval. ACO membership was a statistical assemble, not a consensual affected person panel; sufferers can be assigned to ACOs if their main care physicians participated. The dearth of affected person alternative violated a key precept of the Ellwood/Enthoven mannequin, during which sufferers would select programs of care and reap a monetary reward for making the “proper alternative”.

The second was that suppliers would proceed to be paid Medicare’s payment for service however a shadow accounting system would monitor ACO spending. If ACO spending fell under progress in regional Medicare spending, suppliers would get a bonus. They’d even be required to trace dozens of “high quality” measures and get a small bonus in the event that they exceeded norms. The late Uwe Reinhardt pricelessly characterised “worth based mostly cost” as “fee-for-check-the-box. . . for ideas” . ACOs unfolded as managed care with out the chance, coaching wheels for a later shift to capitation.

Giant business well being plans serving employers shadowed the Medicare ACO program, making the most of yet one more hospital pricing panic based mostly on deeply discounted charges. Most of the plans provided underneath ObamaCare’s insurance coverage exchanges have been of this kind. Whereas it was assumed by suppliers that business ACOs would transfer quickly towards true delegation of danger, a decade on, the chance mysteriously has not handed over to suppliers, who’ve spent at the very least $10 billion making ready for ACOs. Doctor time in serving to handle ACOs and in minutely documenting all these “core measures” is invariably costed at “zero”.

If one counts the bonuses paid out to profitable ACOs, the fee overruns by the ACOs that missed their price targets on the excessive aspect, and the fee to Medicare of organising, administering and monitoring them, this system has but to achieve breakeven. Paid out bonuses tended to be extremely concentrated in these lucky ACOs working in excessive Medicare price markets. To nobody’s shock, physician-sponsored ACOs (facilitated by a profitable trade of organizers and contracting consultants) have decisively outperformed these sponsored by hospitals.

Right now, maybe 14 million common Medicare beneficiaries are in some type of ACO, largely with out their very own data. MedPac has characterised Medicare’s ACO program as a “disappointment” and a current NEJM article by a former head of the Middle for Medicare and Medicaid Innovation (CMMI) discovered that solely 5 of the 59 cost experiments by the company had really saved Medicare cash. If the ACO was meant as a bridge to a “a number of Kaisers in regional markets” well being system, it’s a bridge to nowhere.

Nevertheless, as an “trade”, the ACO motion has been an unimaginable success. The post-ACA push to ACOs created one of the vital profitable consulting franchises within the final forty years. Wags mentioned ACO stood for “Awesome Consulting Opportunity”. And personal fairness facilitators of ACO participation similar to Evolent, Aledade, Agilon and Privia have unicorn stage market caps and are being shopped by personal fairness homeowners and bankers to would-be healthcare disrupters. To echo a Wall Road wag, one wonders the place are the sufferers’ and physicians’ yachts.

All of the whereas, the untransformed common Medicare program has been eclipsed by Medicare Benefit, which employed personal well being plans to arrange and handle Medicare providers for, what’s right now, nicely greater than half of Medicare’s 66 million beneficiaries. This program has been captured by a handful of huge business insurers, two of whom–Humana and United Healthcare–management nearly half of MA’s 33 million beneficiaries, and is by far their most worthwhile line of enterprise.

Precise Capitated Danger for Suppliers has been in Scarce Provide

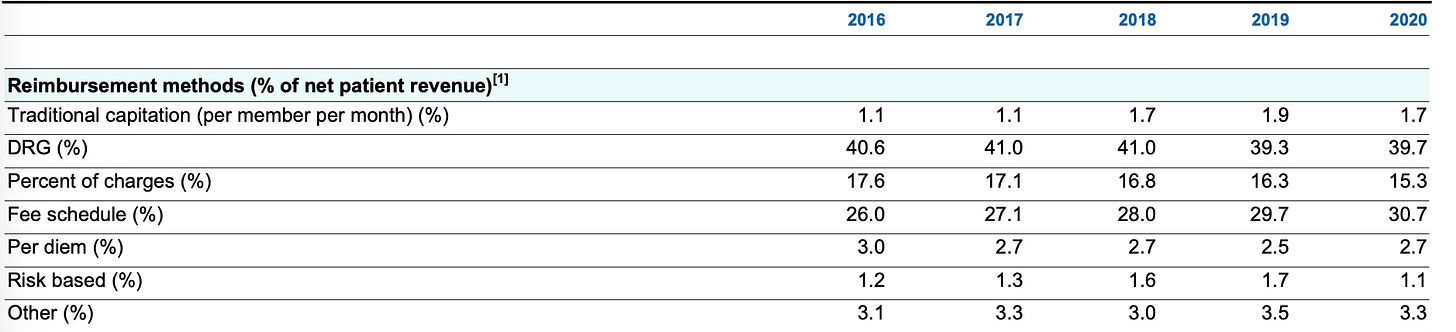

Nevertheless, these massive business carriers have been disinclined to share their danger (and earnings) with care suppliers. Moody’s Investor Service discovered that the median US hospital acquired only one.7% of their revenues from capitation, and one other 1.1% from “two-sided” ACO type danger in 2020, up from 1.1% and 1.2% respectively in 2016.

Hospital Income Sources: Median Values

Supply: Moody’s Investor Service, 2021

By 2013, capitation as a proportion of main care workplace based mostly earnings had fallen to solely 5% from 15% mid the earlier decade, in response to HHS analysts. Present two sided danger earnings for physicians is unknown to this analyst, however is believed to be negligible.

Keep tuned for Half III of this Managed Care Historical past the place we concentrate on the transformation of managed care right into a machine and algorithm pushed surveillance system for physicians and hospitals.

Jeff Goldsmith is a veteran well being care futurist, President of Well being Futures Inc and common THCB Contributor. This comes from his private substack